Level Funded plans compared to fully and self insured plans

Fully Insured Plans

Fully insured plans guarantee acceptance for all employees, regardless of health. This means the insurance company takes on significant risk, leading to high costs even for plans with high deductibles. Although employers often contribute to employees' premiums, the costs for adding spouses and children to a family plan remain very high.

Self Insured Plans

In contrast to a fully insured plan, a self-insured health plan involves employers operating and providing their own health coverage instead of purchasing a plan from an insurance carrier. This approach allows employers more control over their health plan design and potential cost savings. However, self-insuring exposes the company to greater financial risk if more claims than expected need to be paid, as they are responsible for covering all health care costs incurred by their employees.

Level Funding Plans

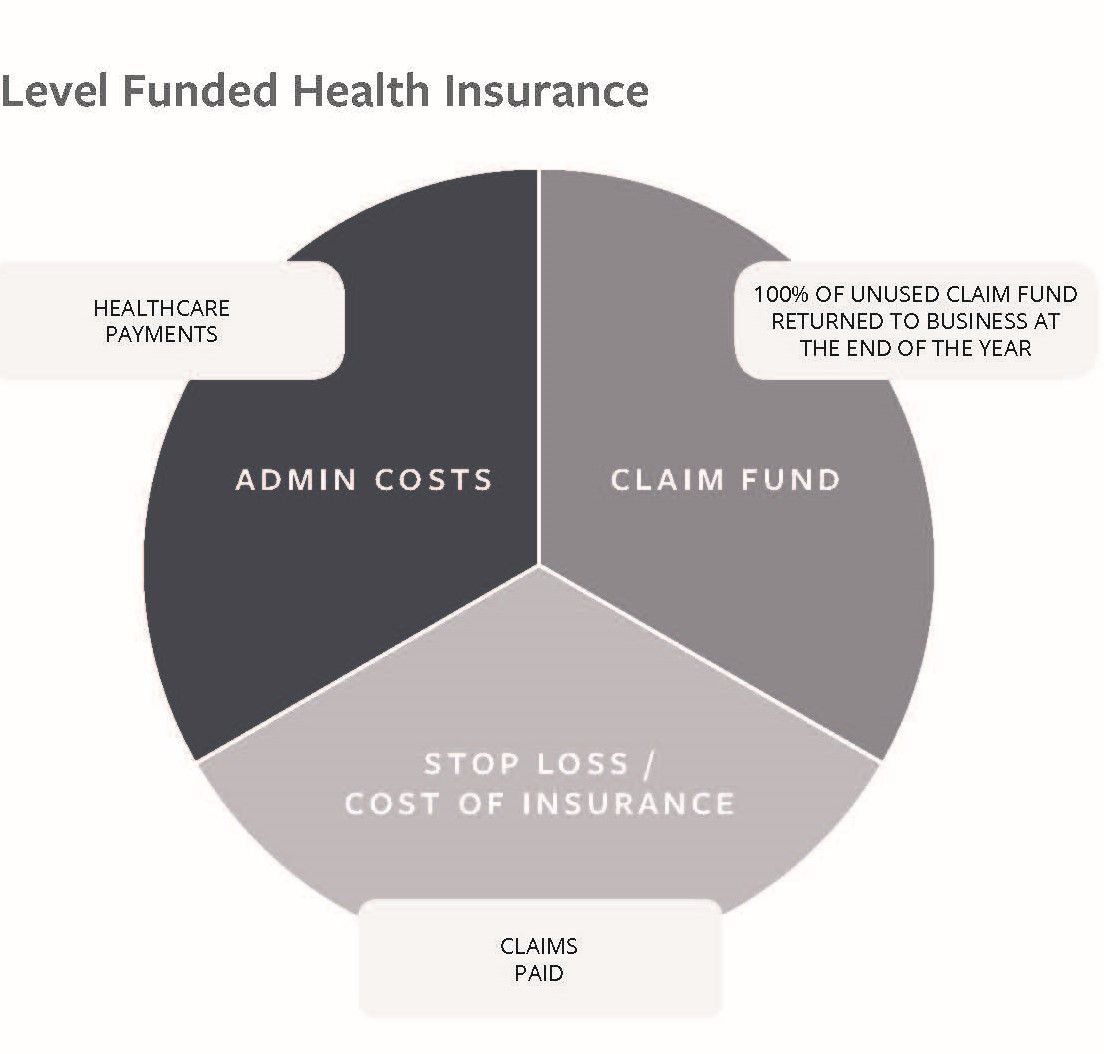

Level funding is a third option that combines the benefits of fully insured and self-insured plans without their respective risks.

How does it work?

- Level Premiums: You self-insure but pay a fixed monthly premium, offering lower costs than a fully insured plan without the risks of a self-insured plan.

- Stop-Loss Insurance: Level-funded plans include individual and group stop-loss insurance, protecting your company and employees in worst-case scenarios.

- Potential Refunds: If actual claims are lower than expected, you receive a refund for the difference, ensuring you only pay for the healthcare costs incurred by your employees.

In summary, level funding provides the predictable costs of a fully insured plan while only paying for the actual healthcare expenses incurred. You get the benefits of both plans without the risk.

| PERKS OF A LEVEL FUNDED INSURANCE PLAN | |

|---|---|

| UP TO 40% SAVINGS | from your existing healthcare plan |

| ALL EMPLOYEES ARE ELIGIBLE | regardless of health, for the insurance at a flat rate across the company. Pre-existing condtions are still covered |

| A 100% EXACT COPY OF YOUR EXISTING PLAN | same deductibles, same networks, doctors, drug pla, etc. Nothing changes and in most cases your employees will never notice any change at all |

| COMPLETE CUSTOMIZATION | every plan can add larger networks, a greater range of deductibles, and co-pays from doctor visits to prescriptions |

| NATIONWIDE ACCESS | we allow employers with employees across multiple states to use one compan, one bill, with identical coverage for all employees regardless of where they work and live |

| FULL TRANSPARENCY | preset monthly payments - based on the number of covered employees, the total cost represents the maximum you will pay. Payments do no fluctuate based upon claims experience |

| ALL YOU NEED WITH ONE STOP | from payroll, dental, vision, life, disability, critical illness, telemedicine, HSA, 401k, retirment and more. All on one bill, one easy enrollment, with an app for each employee for easy access to make changes to the plan, add or change coverage, view policy cards, file claims etc |

| EASY ENROLLMENT | all employees will have full 24/7/365 access to their plans online and via mobile app. From here they can modify, enroll, unenroll, add family members, change reitrement contributions, view policy details, policy cards, even file claims and see status. All billing is flawlessly and automatically updated for each payroll period. |

Is there a catch?

Fully funded plans are expensive because the insurance company assumes the worst-case scenario, leading to higher rates, especially for younger and healthier employees.

Discounts for Healthier Groups: Similar to safe driver discounts in car insurance, we offer discounted rates for groups with good employee health.

Health Assessment: We ask basic health questions regarding current or past issues like cancer, heart problems, organ transplants, and upcoming surgeries. The healthier the group, the lower the cost for the plan.

Guaranteed Coverage: Rest assured, 100% of employees will be eligible for the same plan at the same price, with no exclusions or increased rates. Even in worst-case scenarios for less healthy groups, the cost will remain the same, never higher.

Year-End Accounting Examples:

| CLAIMS RUN FAVORABLY | CLAIMS RUN UNFAVORABLY | ||

|---|---|---|---|

| Annual Claims Funding | $200,000 | Annual Claims Funding | $200,000 |

| Paid Claims | ($160,000) | Paid Claims | ($240,000) |

| Surplus | $40,000 | Deficit | ($40,000) |

| PAID BY STOP LOSS | ($40,000) |

MAKING THE DECISION.

YOU HAVE A CHOICE!

WHAT IS SELF FUNDING?

Self-funding is a funding vehicle for employee benefit plans where the employer "self-funds" their health benefits. In this arrangement, the employer assumes some of the risk but also reaps the rewards.

An employer's risk in self-funding is managed with stop-loss insurance. This insurance provides protection against catastrophic claims, ensuring self-funded employers do not assume full liability. Stop-loss insurance kicks in if an employer's costs exceed certain preset limits.

HOW DOES SELF-FUNDING WORK?

Our TPA processes medical claims just like insurance companies, but with a personal touch. We manage your money as if it were our own, carefully evaluating each claim instead of paying or denying blindly. We prioritize the financial well-being of your plan, employees, and their families.

For added security and protection, the plan may purchase excess loss coverage. This coverage kicks in if claims for any single participant (specific) or for all participants combined (aggregate) exceed the selected deductible amounts.

TAKE CONTROL of Your Group Health Plan

Let us show you how. Talk to our self-funding experts about your needs, and we'll design a well-suited, cost-effective plan for you.

GREATER FLEXIBILITY

- Customizable benefit plans tailored to your business

- Adjustable as your organizational needs change

EASE OF ADMINISTRATION

- Cost savings on mandated plan benefits and no state premium tax

- Centralized services from a comprehensive third-party administrator

IMPROVED CASH FLOW

- Pay for actual claims, not projected claims

Any funds saved can roll over year after year

We take the expense and hassle out of health care

SMARTER BENEFITS

Rising costs have made open enrollment a dreaded time for both employers and employees. No one is thrilled about the increased expenses and unpopular plan changes required just to maintain the status quo. At Omni Solutions, it's time to break the old employee benefit mold and offer innovative solutions that alleviate financial burdens while providing quality coverage.

WHY USE US?

Not only do we have unique plans and cost saving concepts, but our partner's size and buying power in numbers enable us to get you a much lower rate through our wholesale rates. It costs nothing to use us and in fact we pass the savings on to you while assuring you the absolute lowest rates for your company.

EMPLOYERS

We know that you value the people working hard for you (W2 or 1099 contractors). If you are currently unable to offer benefits we have found it is because of one these reasons:

- The cost for coverage seems too high

- Believe there aren't enough employees to qualify

- Dealing with payroll and deductions seems too daunting

- Uncertain of the legalities involved with offering coverage to contracted employees

Let us help you navigate the process and overcome these issues!

HEALTH INSURANCE REVIEW

Companies are experiencing 15% to 35% premium increases year after year, which is why our team will review your current plan to assess the cause of the rate increases. No cost for first time clients.

EMPLOYEE BENEFITS PLANS

Once we have identified the key underlying causes of your recent rate increases, the team will then start customizing a plan from the ground up. By partnering with premier insurance carriers and utilizing industry leading underwriting technology, we are able to save most companies on their group major medical premiums.